Discover cost-effective payroll solutions and compliance strategies for Indian manufacturing companies : 2025-26 industry guide.

Sector Spotlight: Payroll in Manufacturing Companies 2025-26

Introduction

Manufacturing companies in India are experiencing rapid transformation with evolving workforce dynamics, regulatory frameworks, and increasing operational complexities. Strategic payroll outsourcing benefits for manufacturing firms India 2025-26 are now critical to achieving compliance, cost efficiency, and streamlined operations.

This guide provides an expert overview of the unique payroll challenges in the manufacturing sector, how cost-effective payroll solutions for Indian manufacturing firms can resolve these.

Understanding Payroll Challenges in Manufacturing

Manufacturing payroll involves complexities distinct from other sectors due to diverse employee categories—staff, contractual workers, seasonal labor—and compliance with variable labor laws.

Common Payroll Processing Challenges in Manufacturing

- Managing multiple wage types (hourly, monthly, piece-rate)

- Handling labor union agreements and bonus calculations

- Complex statutory deductions with region-specific regulations

- Tracking overtime, shift differentials, and leave accruals

Why Outsourcing Payroll Benefits Manufacturing Firms

Payroll outsourcing in manufacturing delivers critical advantages:

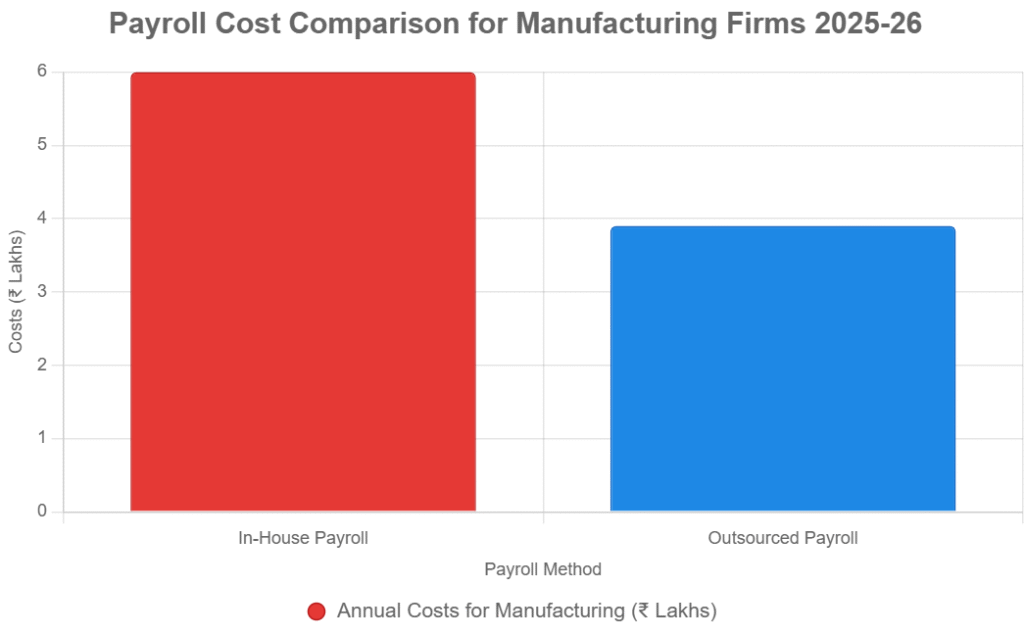

Cost-Effective Payroll Solutions for Indian Manufacturing Firms

Labor-intensive in-house payroll consumes time, incurs training costs, and risks costly errors. Outsourcing converts fixed overhead to a predictable variable cost, saving money while maintaining accuracy.

Manufacturing Payroll Compliance and Management Services India 2025-26

Outsourcing ensures full adherence to labor laws such as the Factories Act, Minimum Wages Act, ESI, PF regulations, and bonus distributions — mitigating compliance risks that lead to penalties.

Automated Payroll Systems for Factory Workforce

Modern solutions provide automated payroll calculations that handle complex manufacturing pay scales, statutory deductions, and generate real-time reports for management oversight.

Step-by-Step: Implementing Payroll Outsourcing in Manufacturing

Step 1: Analyze Existing Payroll Workflow

Map out current payroll processes, employee categories, pay structures, and compliance challenges.

Step 2: Vendor Selection and Scope Definition

Evaluate providers like JZ Payroll Outsourcing & Contract Staffing offering specialized knowledge in manufacturing payroll nuances.

Step 3: Data Migration & System Integration

Secure transfer of employee payroll data into automated cloud platforms ensuring minimal disruption.

Step 4: Training & Employee Self-Service Portal Rollout

Enable factory employees and HR teams to access payslips, benefits info, and queries online.

Step 5: Ongoing Monitoring & Compliance Audits

Regular audit and reconciliations prevent discrepancies and ensure regulatory adherence.

Unique Insights: Pitfalls to Avoid

- Ignoring workforce segmentation complexities leads to errors

- Overlooking statutory updates from central and state governments

- Lack of integration between timekeeping and payroll systems impairs accuracy

Manufacturing Payroll Outsourcing ROI Calculator

Estimate the ROI for payroll outsourcing in manufacturing firms in India 2025-26.

Case Study: Efficient Payroll Outsourcing for a Pune-Based Manufacturer

A Pune manufacturing SME with 700+ employees, including contract laborers, faced challenges in payroll accuracy, compliance risk, and IT overhead.

Upon partnering with JZ Payroll Outsourcing & Contract Staffing, the firm transitioned to an automated system tailored to manufacturing-specific rules. JZ managed statutory deductions, labor union compliances, and provided multi-location payroll services. The company recorded:

- 35% reduction in payroll processing costs

- Zero statutory penalties in audits over 2 years

- Significant time savings allowing HR focus on workforce development

Payroll Audit and Reconciliation in Manufacturing Companies

Routine payroll audits detect inconsistencies early, minimizing risks of non-compliance. Accurate reconciliation of wages, deductions, and bonuses ensures transparency and trust in employer-employee relations.

Why Choose JZ Payroll Outsourcing & Contract Staffing?

With over 20 years of expertise serving Indian manufacturers and global clients, JZ Payroll Outsourcing & Contract Staffing leads in delivering tailored solutions. Their deep understanding of sector nuances, compliance frameworks, and advanced technologies shields businesses from risk while enabling operational excellence.

FAQ Section

- What payroll challenges are unique to manufacturing?

Diverse pay structures, seasonal labor, and compliance with multiple labor laws. - How does outsourcing payroll benefit manufacturing companies?

Cost savings, enhanced compliance, operational scalability, and workforce transparency. - What statutory compliances are critical in manufacturing?

Factories Act, Minimum Wage Act, PF, ESI, Bonus regulations. - Can payroll outsourcing handle union-specific agreements?

Yes, experts customize payroll systems to respect union contracts and bonus structures. - How does automated payroll improve manufacturing HR efficiency?

It reduces manual errors, accelerates processing, and enhances reporting capabilities. - Is JZ Payroll Outsourcing suitable for multi-location manufacturers?

Absolutely, with expertise in managing dispersed manufacturing workforces across states. - What steps are involved in transitioning to an outsourced payroll system?

Assessment, vendor selection, data migration, training, and continuous support.

Manufacturing companies looking to enhance their payroll accuracy, reduce costs, and ensure compliance must embrace strategic payroll outsourcing benefits for manufacturing firms India 2025-26. Partner with JZ Payroll Outsourcing & Contract Staffing—trusted experts offering customized, compliant, and scalable payroll and staffing services.

Contact us today at 9911824722 or email pyushverma@contractstaffinghub.com for a personalized consultation and take the first step toward streamlined payroll excellence.