Comprehensive pan India payroll outsourcing with multi-city management, compliance, and scalable solutions. Trusted by SMEs & startups. Contact JZ Payroll today!

Pan India Payroll: Serving Every Major City Efficiently

Effective payroll management is a cornerstone of running a successful business—especially across the diverse and expansive landscape of India. For small and medium-sized businesses (SMBs), startups, and global entrepreneurs expanding here, pan India payroll outsourcing services 2025-26 provide the key to compliance, accuracy, and workforce agility.

In this authoritative guide, discover how payroll providers expertly handle multi-city payroll management in India through advanced technology, robust compliance processes, and localized expertise. We’ll explore operational challenges, best practices, and why partnering with JZ Payroll Outsourcing & Contract Staffing ensures smooth, error-free payroll covering every major Indian city.

Why Pan India Payroll Outsourcing?

India’s workforce is dynamic, dispersed, and regulated by a complex mosaic of central and state labor laws. Whether your team is in Delhi, Mumbai, Bangalore, or tier-2 cities—ensuring payroll accuracy and compliance is critical.

- Payroll compliance management across Indian states can be challenging due to varying tax structures, professional tax slabs, and labor welfare fund rules.

- Local payroll tax and labor law adherence require specialized knowledge geographically.

- Inconsistent or delayed payroll leads to employee dissatisfaction, legal penalties, and business risk.

Thus, entrusting a multi-city payroll management provider in India brings peace of mind and operational efficiency. These providers leverage automated payroll software integration India alongside expert teams to craft tailored payroll solutions for urban and remote offices alike.

Understanding Multi-City Payroll Management in India

Step 1: Data Collection & Local Statutory Mapping

Accurate payroll begins with collecting comprehensive employee data: attendance, leaves, salary components, exemptions, and deductions applicable per city/state. Providers map these against mandate variations like Professional Tax, Gratuity, and labor welfare contributions.

Step 2: Automated Payroll Processing & Disbursal

Advanced systems ensure secure payroll systems for pan India workforce operate without errors. Salary processing includes all statutory deductions and benefits and supports multi-location salary disbursement services for transparent payments.

Step 3: Compliance Auditing & Reporting

Regulatory audits are simplified via payroll audit and reconciliation India, enabling businesses to remain inspection-ready. Specialized reporting also helps management monitor payroll costs and compliance status.

Step 4: Employee Empowerment Through Self-Service

Modern payroll solutions enable employee self-service portals for Indian cities offering instant payslip access, tax document downloads, and leave balance checks, enhancing engagement and reducing HR queries.

Benefits of Partnering with JZ Payroll Outsourcing & Contract Staffing

JZ Payroll Outsourcing & Contract Staffing specializes in delivering customizable, end-to-end payroll and staffing services tailored for the unique complexities of India’s multi-jurisdictional environment.

- Deep expertise in payroll processing for remote and urban employees ensures all locations are covered.

- We embed compliance checks for city-specific payroll tax and labor law adherence, eliminating risks.

- Proprietary secure payroll systems for pan India workforce deliver accuracy, confidentiality, and scalability.

- Robust integration of automated payroll software in India streamlines workflows.

- End-to-end multi-location salary disbursement reduces overhead and enhances employee satisfaction.

- Comprehensive payroll audit and reconciliation means peace of mind during government inspections.

- Innovative employee self-service portals empower your workforce with transparency and autonomy.

Payroll Outsourcing ROI Calculator

Estimate the ROI for payroll outsourcing in India 2025.

Case Study: Scaling Payroll Across Indian Cities with JZ

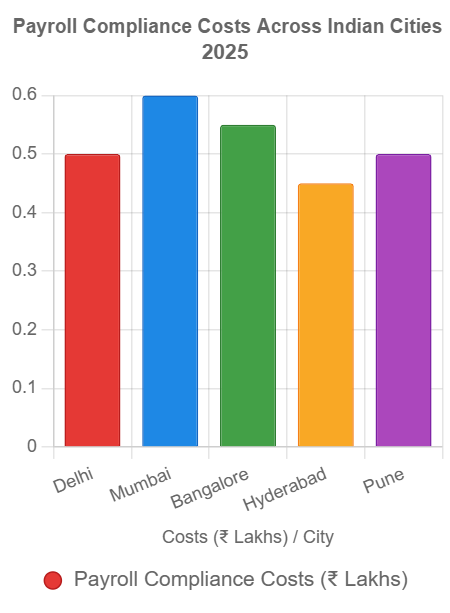

A leading Mumbai-based IT startup sought to streamline its payroll across 8 Indian cities, including Bangalore, Hyderabad, and Pune. With pan India payroll outsourcing services, JZ customized payroll templates to reflect each city’s local tax norms and compliance. With real-time dashboards, the client monitored multi-city payroll costs and statutory submissions effortlessly.

Result?

- 99.8% error-free payroll processing

- Zero penalties on labor audits

- 40% time saved in payroll administration

- Highly satisfied and engaged remote and urban employees

This partnership allowed the startup to scale rapidly without payroll bottlenecks, reinforcing JZ’s role as their trusted partner.

Best Practices for Pan-India Payroll Outsourcing

- Centralize with Localization: Use unified payroll tech platforms capable of local jurisdiction customizations.

- Regular Compliance Audits: Perform frequent internal and vendor audits of payroll data and statutory filings.

- Employee Training on Self-Service: Educate workforce on using portals for transparency and efficiency.

- Use Advanced Automation: Integrate AI and cloud tech for real-time payroll processing and exception handling.

- Maintain Communication: Ensure clear communication channels between payroll provider, HR, and employees.

Frequently Asked Questions (FAQ)

- What makes pan India payroll outsourcing different?

It accounts for diverse tax, labor, and regulatory requirements unique to each state and city. - How do providers handle compliance across multiple locations?

They maintain up-to-date regulatory databases and tailor calculations accordingly. - Can workers in remote locations access payroll info digitally?

Yes, employee self-service portals provide secure and instant access. - Are salary disbursements synchronized across locations?

Top providers ensure timely payments across all sites with centralized oversight. - How can payroll audits help my business?

Audits identify errors, reduce penalties, and improve financial forecasting. - Is outsourcing payroll cost-effective for SMBs in India?

Absolutely; it reduces manual efforts, errors, and legal risks dramatically. - Why choose JZ Payroll Outsourcing & Contract Staffing?

With 20+ years of deep Indian & global expertise, JZ offers tailored, reliable, and compliant payroll solutions trusted by businesses nationwide.

Partner with India’s leading multi-city payroll management provider and experience seamless, compliant, and secure payroll that serves every major city efficiently.

📞 Call us at 9911824722 for your free consultation

✉️ Email: = pyushverma@contractstaffinghub.com

🌐 Visit: www.contractstaffinghub.com