Discover financial advantages & cost savings of payroll outsourcing for SMEs in India in 2025-26.

The Cost Benefits of Outsourcing Payroll: A Definitive Guide for Indian Businesses in 2025-26

Handling payroll is one of the most critical yet complex functions for businesses operating in India today. With evolving regulatory frameworks, state-specific tax laws, and dynamic workforce needs, many small to medium-sized companies struggle to balance accuracy, compliance, and efficiency. The solution? Leveraging payroll outsourcing cost savings for SMEs India through trusted providers like JZ Payroll Outsourcing & Contract Staffing.

This comprehensive guide explores the financial advantages of outsourced payroll management in 2025, illustrating not only cost savings but also enhanced operational resilience. Whether a startup, SME, or global entrepreneur entering Indian markets, understanding these benefits helps you make informed decisions for business growth.

Why Outsourcing Payroll Makes Financial Sense in India

Managing payroll internally demands infrastructure, technology, and expertise—all with significant hard and soft costs. Outsourcing, conversely, converts these into scalable variable costs while avoiding common pitfalls.

Reduced Payroll Processing Expenses

Outsourcing minimizes or eliminates the need for dedicated payroll staff, expensive software licenses, and training. This leads to substantial direct savings on manpower and tools, a crucial factor for budget-conscious SMEs.

Improved Accuracy Lowering Penalty Risks

Improved accuracy lowering penalty risks is a major cost benefit. Errors in salary calculations, tax deductions, or statutory compliance result in fines, legal exposure, and reputational damage. Expert payroll providers use advanced technologies and compliance teams, greatly reducing these risks.

Scalable Payroll Solutions for Growing Businesses

Payroll complexities grow with headcount and geographic diversity. Outsourcing allows you to access scalable payroll solutions for growing businesses—pay only for what you need as your workforce expands without overhead spikes.

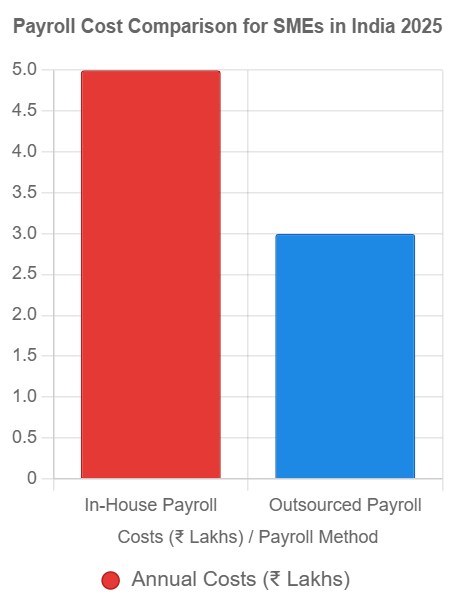

Breaking Down the ROI on Payroll Outsourcing Investments

Many businesses hesitate initially due to perceived costs. Understanding the true ROI involves considering:

- Direct cost savings from payroll operational cost optimization.

- Avoidance of costly penalties through expert payroll compliance reducing fines.

- Capturing time saved in administrating payroll, freeing HR teams to focus on strategic growth—quantified as time savings through automated payroll.

- Minimizing disruptions and cost of errors with payroll error mitigation and audit readiness.

Payroll Outsourcing ROI Calculator

Estimate the ROI for payroll outsourcing in India 2025.

Step-by-Step Guide to Calculating Your Cost Benefits

Step 1: Assess Current In-house Expenses

Include salaries for payroll staff, technology subscription fees, compliance training, and audit rework costs.

Step 2: Estimate Outsourcing Costs

Obtain quotes from providers like JZ Payroll Outsourcing & Contract Staffing, factoring in service scope and headcount.

Step 3: Calculate Risk Mitigation Savings

Factor in historical penalties or error costs and forecast reductions.

Step 4: Account for Productivity Gains

Quantify freed HR time and operational agility enabling faster decision-making and execution.

Case Study: JZ Payroll Outsourcing Empowers Growing SME in Delhi NCR

ABC Manufacturing, a mid-sized firm in Delhi NCR, faced rising payroll error rates and compliance costs as it expanded to 600+ employees across multiple states. Partnering with JZ Payroll Outsourcing & Contract Staffing, ABC transitioned to outsourced payroll management including automation, compliance audits, and employee self-service portals.

Results:

- Reduced payroll-related operational costs by 38%

- Achieved 99.7% payroll accuracy, zero penalties in subsequent audits

- Freed 200+ man-hours per month for HR strategic initiatives

- Streamlined payroll across multi-city operations with full compliance assurance

This realized ROI validated the upfront investment and catalyzed ABC’s continued growth.

Best Practices to Maximize Cost Benefits with Payroll Outsourcing

- Choose providers with proven expertise in payroll outsourcing cost savings for SMEs India.

- Ensure contracts include comprehensive compliance and audit support.

- Invest in providers offering modern technologies for automated payroll software integration India.

- Regularly monitor performance metrics and cost-saving achievements.

Frequently Asked Questions (FAQ)

- How does payroll outsourcing save money for SMEs?

By reducing overhead, manpower costs, and error-related penalties. - Is payroll outsourcing compliant with Indian laws?

Expert providers maintain up-to-date compliance with all tax and labor regulations. - How quickly can SMEs scale payroll services?

Outsourcing services are designed to grow flexibly with your business needs. - Are there hidden costs to payroll outsourcing?

Reputable firms like JZ offer transparent pricing with no surprises. - Can payroll outsourcing improve accuracy?

Yes, automation and expert audits significantly reduce errors. - How secure is outsourced payroll data?

Data security is paramount, with encryption and access controls standard. - Why choose JZ Payroll Outsourcing & Contract Staffing?

20+ years’ cross-sector expertise ensures tailored solutions minimizing costs and risks.

Unlock the full cost benefits of payroll outsourcing services India 2025-26 with JZ—your trusted, expert partner for compliant, scalable, and efficient payroll management.

📞 Call: 9911824722

✉️ Email: pyushverma@contractstaffinghub.com

🌐 Visit: www.contractstaffinghub.com

Contact our experts today for a personalized consultation and discover how payroll outsourcing transforms your business finances.