Avoid top payroll compliance errors for startups and SMEs in India. Learn how JZ Payroll Outsourcing fixes payroll mistakes for reliable, compliant payroll.

Payroll management is critical yet complex for Indian startups, SMEs, and growing companies. Even small errors can cause penalties, employee dissatisfaction, and legal issues. This guide highlights the top 5 common payroll mistakes Indian SMEs 2025-26 must avoid and how JZ Payroll Outsourcing & Contract Staffing offers expert solutions for error-free, streamlined payroll.

Understanding Payroll Mistakes and Their Impact

- Payroll errors increase compliance risks and can trigger audits with costly penalties.

- Employee trust erodes when paychecks are delayed or incorrect.

- Manual processes raise the risk of payroll data entry errors and statutory miscalculations.

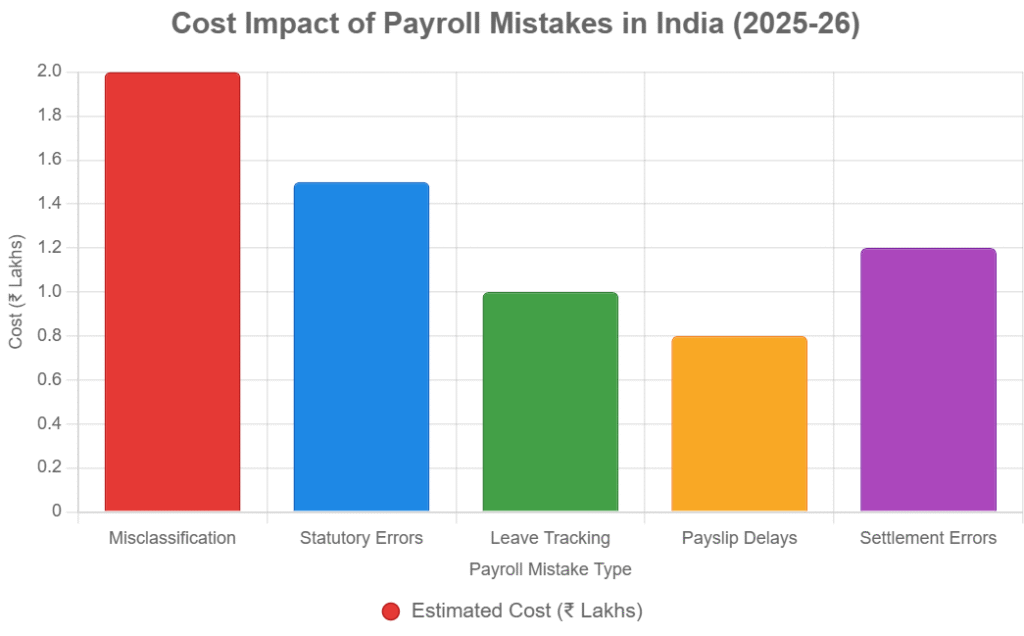

The Top 5 Payroll Mistakes Indian SMEs Make

1. Employee Misclassification Payroll Errors

Many startups incorrectly classify part-time, contract, or freelance workers as full-time employees or vice versa, affecting PF, ESI, and tax compliances.

2. Statutory Deduction Calculation Mistakes

Errors in calculating contributions like PF, ESI, TDS, and professional taxes lead to penalties and legal notices.

3. Inaccurate Leave and Attendance Tracking

Poor integration of attendance data causes wrong salary calculations, overtime mistakes, and payroll disputes.

4. Late Payslip Generation Issues

Delays in payslip issuance impact employee transparency, loan approvals, and compliance under Shops & Establishment Acts.

5. Payroll Final Settlement Errors

Mismanaged exit formalities and final settlements trigger legal cases and damage employer branding.

How JZ Fixes Payroll Mistakes with Expert Solutions

- Automated, compliant payroll systems that eliminate manual errors and delays.

- Real-time payroll compliance risk mitigation, updating statutory rules instantly.

- End-to-end management of leave, attendance, deductions, payslips, and settlements.

- Dedicated payroll experts who handle employee misclassification payroll errors and educate HR teams on best practices.

- Transparent communication channels improving employee trust and reducing disputes.

Payroll Error Correction ROI Calculator

Estimate the return on investment for fixing payroll errors in India 2025-26.

Unique Insights & Actionable Tips

- Integrate biometric or GPS attendance systems for accurate leave and attendance tracking.

- Conduct quarterly payroll audits with JZ to identify hidden compliance risks.

- Use payroll analytics dashboards to monitor payroll KPIs and optimize workflows.

Case Study: How JZ Payroll Outsourcing Prevented Costly Penalties for a Delhi Tech Startup

A fast-growing Delhi tech startup faced fines due to statutory deduction calculation mistakes and manual payroll errors. Partnering with JZ Payroll Outsourcing, the startup automated payroll processes, ensuring timely PF, TDS, and ESI filings. JZ’s expert team conducted a comprehensive payroll compliance risk mitigation audit identifying potential breaches early. The startup saw zero penalties in subsequent audits, improved employee satisfaction with prompt payslips, and saved 30% of HR time, enabling focus on core growth initiatives.

FAQ Section

- What are common payroll mistakes Indian SMEs make?

Misclassification, calculation errors, and poor attendance tracking top the list. - How can payroll compliance errors affect startups?

They lead to fines, audits, and loss of employee trust. - Can JZ Payroll Outsourcing help fix payroll mistakes?

Yes, with automated systems and expert consultations ensuring compliance. - Why is attendance tracking important for payroll accuracy?

Accurate tracking ensures correct salary and overtime payments. - What happens if payslips are delayed?

It affects employee transparency and compliance with labor laws. - How often should payroll audits be conducted?

Quarterly reviews help detect and fix errors early. - What documents are needed for final payroll settlements?

Salary records, leave balances, bonuses, and statutory dues details.

Why Partner with JZ Payroll Outsourcing & Contract Staffing?

With over 20 years of expertise, JZ Payroll Outsourcing & Contract Staffing is the leading provider for common payroll mistakes Indian SMEs 2025-26, payroll compliance errors for startups India 2025-26, and tailored payroll outsourcing solutions. We combine global best practices with a deep understanding of Indian regulations to secure compliant, efficient payroll operations for startups, SMEs, and multinational enterprises.

Avoid costly payroll mistakes and keep your business compliant. Contact JZ Payroll Outsourcing & Contract Staffing today for a free consultation or download our Payroll Compliance Checklist.

📞 Phone: 9911824722

📧 Email: pyushverma@contractstaffinghub.com

🌐 Website: www.contractstaffinghub.com