Simplify payroll statutory compliance with expert guidance. Corporate payroll tax compliance essentials & checklist for Indian companies in 2025 by JZ Payroll Outsourcing.

Compliance Made Simple: Payroll Law Essentials for Corporates

Navigating the complex maze of payroll compliance is a critical challenge for corporates and growing businesses in India. As statutory requirements evolve with new labour laws and tax regulations, ensuring timely and accurate adherence is key to avoiding penalties, safeguarding employee trust, and maintaining operational efficiency.

This guide demystifies corporate payroll compliance requirements India 2025, outlining a comprehensive payroll statutory compliance checklist for corporates India, and emphasizing essential payroll tax compliance essentials for Indian companies 2025. With actionable practices and expert insights, this resource empowers businesses to confidently manage their payroll landscape.

Understanding the Indian Payroll Compliance Framework

Payroll compliance in India is governed by an array of central and state laws, designed to protect employee rights while regulating employer obligations. Corporates must understand multiple dimensions, including:

- Statutory deductions and filings such as Provident Fund (EPF), Employees State Insurance (ESI), Tax Deducted at Source (TDS), and Professional Tax.

- Timely and accurate submission of monthly, quarterly, and annual statutory returns.

- Maintenance of payroll records and audit readiness.

Coding payroll processes within this legal framework ensures companies avoid penalties and foster workforce satisfaction.

Step-by-Step Payroll Compliance Checklist for Corporates

Step 1: Employee Registration & Documentation

- Register with EPFO, ESIC, Income Tax Department (TAN), and state Professional Tax authorities.

- Collect employment documents including PAN, Aadhaar, salary structure details, and statutory declarations.

Step 2: Payroll Processing & Statutory Deductions

- Calculate gross salary, allowances, deductions (PF, ESI, TDS, professional tax) accurately.

- Use automated payroll compliance solutions to eliminate manual errors.

Step 3: Filing & Remittances

- Deposit contributions to EPF, ESI, TDS, and professional tax before prescribed due dates.

- File statutory returns such as Form 24Q (TDS), Form 12BB (declarations), EPF returns, and ESIC filings.

- Step 4: Recordkeeping & Audits

- Maintain payslips, challans, attendance, leave, and salary registers digitally and physically.

- Conduct periodic internal audits for compliance verification and readiness for government inspections.

Step 5: Continuous Updates & Training

- Monitor updates in labour laws, tax slabs, and statutory limits.

- Train payroll staff on compliance essentials and legislative changes.

Payroll Compliance ROI Calculator

Estimate the return on investment for payroll compliance in India 2025.

Unique Insights & Common Pitfalls

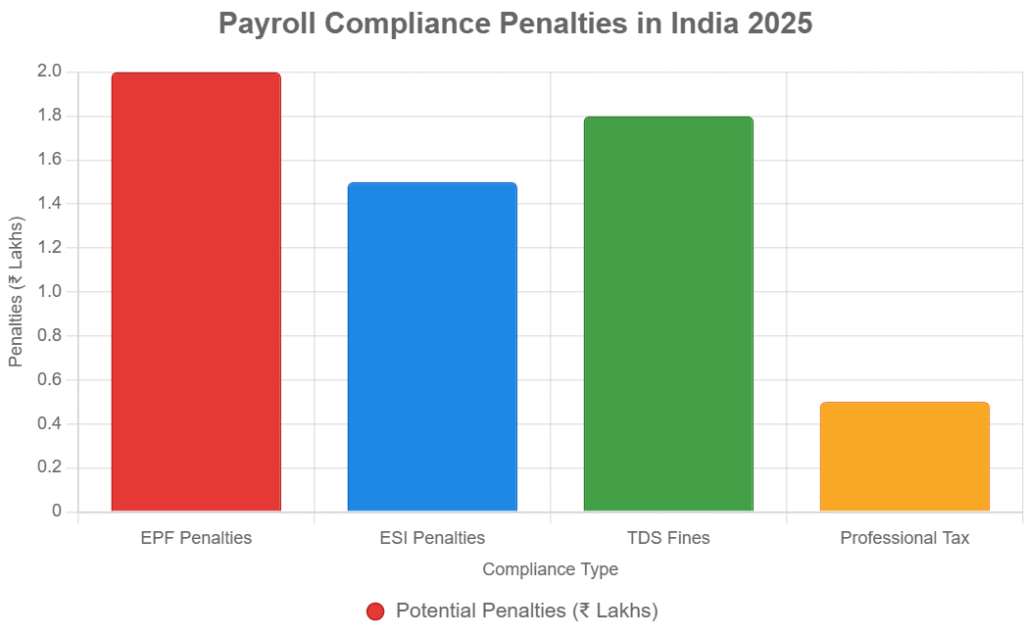

- Many corporates underestimate the impact of professional tax compliance India, leading to unexpected fines.

- Late TDS deposits and EPF filings attract interest and legal action.

- Employing integrated payroll software vastly reduces errors and streamlines statutory filings.

- Regular compliance audits with expert service providers prevent costly penalties.

Case Study: How JZ Payroll Outsourcing Ensured Compliance for a Multinational in Delhi NCR

A multinational IT company with 1,000+ employees in Delhi struggled to keep pace with evolving payroll statutory requirements, risking financial penalties and employee dissatisfaction. Partnering with JZ Payroll Outsourcing & Contract Staffing, the company implemented automated payroll systems and expert process oversight. JZ ensured timely remittances for EPF, ESI, and TDS and provided comprehensive compliance reporting. The firm reported zero non-compliance incidents in government audits post-engagement and realized a 20% reduction in administrative overhead.

Frequently Asked Questions (FAQ)

- What are key payroll compliance requirements for corporates in India?

Registration with statutory bodies, timely deductions, filings, and maintenance of accurate records. - How does JZ Payroll Outsourcing assist with compliance?

By providing expert consultation, automated solutions, and end-to-end statutory management. - Are all companies required to comply with EPF and ESI?

Companies with 20+ employees for EPF and 10+ employees for ESI must comply. - What penalties apply for non-compliance?

Fines, legal notices, interest on delayed payments, and reputational damage. - How often are payroll returns filed?

Monthly, quarterly, and annually depending on the statutory body and return type. - What software can help automate payroll compliance?

Cloud-based platforms integrated with statutory updates reduce manual errors significantly. - Can payroll compliance requirements vary by state?

Yes, especially concerning professional tax and labour-specific regulations.

Why Choose JZ Payroll Outsourcing & Contract Staffing?

With over two decades of experience, JZ Payroll Outsourcing & Contract Staffing is India’s most trusted partner for corporate payroll compliance requirements India 2025 and beyond. Our custom solutions, technological expertise, and deep regulatory knowledge support businesses across sectors with scalable, compliant payroll and staffing services.

Simplify payroll compliance and protect your business. Contact JZ Payroll Outsourcing & Contract Staffing today for your personalized compliance consultation or download our Corporate Payroll Compliance Checklist.

📞 Phone: 9911824722

📧 Email: pyushverma@contractstaffinghub.com

🌐 Website: www.contractstaffinghub.com