Discover how payroll outsourcing reduces costs for startups and SMBs in India. Affordable, scalable payroll services by JZ Payroll Outsourcing for compliant growth.

Small businesses often face unique challenges balancing growth ambitions with resource constraints. Payroll management, one of the most critical administrative functions, requires accuracy, compliance, and efficiency. For many Indian startups and SMEs, payroll outsourcing cost savings for small businesses India 2025 is no longer a luxury but a necessity, enabling focus on core business activities and minimizing risk.

This guide clarifies how payroll outsourcing significantly lowers operational expenses, reduces compliance risks, and enhances workforce management efficiency, positioning your business for scalable success in today’s competitive market.

The Strategic Financial Benefits of Payroll Outsourcing

Step 1: Lower Payroll Processing Expenses

Maintaining dedicated payroll staff, software licenses, and regular training can consume significant fixed costs. Payroll outsourcing converts these into variable costs — you pay only for services used. Benefits include:

- Access to expert payroll compliance without hiring specialists.

- Shared technology costs that small businesses cannot afford individually.

- Minimization of errors reducing costly audits and penalties.

Step 2: Improved Payroll Accuracy and Efficiency

Automated payroll platforms paired with domain expertise provide:

- Error-free salary calculations and statutory deductions (PF, ESI, TDS).

- Timely generation of payslips and tax filings.

- Seamless integration with attendance and leave management systems.

Compliance and Risk Mitigation Advantages

- Reduced risk of regulatory penalties afforded by specialist providers versed in dynamic Indian labor laws.

- Continuous updates and audits to handle evolving compliance requirements.

- Transparent reporting and documentation ready for government inspections or audits.

Operational Impact & Business Growth

Streamlined Payroll Operations for Small Business

Outsourcing payroll reduces the administrative workload and document errors, facilitating smooth employee salary processing and compliance adherence.

Scalable Payroll Services for Growing Companies

Payroll outsourcing scales flexibly as you expand—whether growing your headcount or extending operations.

Diverted Focus to Core Business Activities

By entrusting payroll functions to specialists, management can dedicate more time and resources to innovation, marketing, and customer engagement.

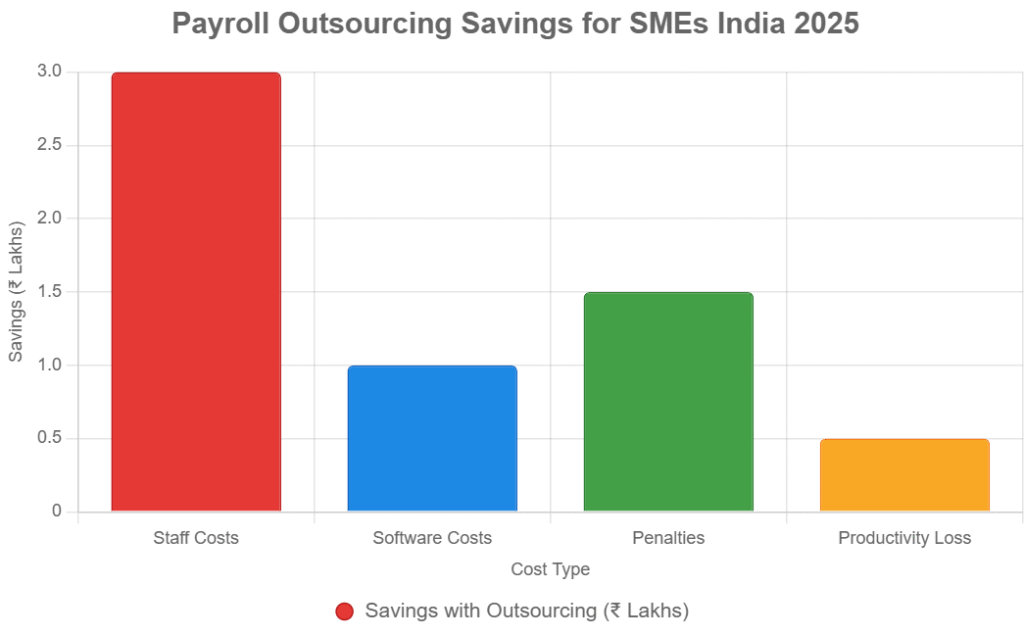

Payroll Outsourcing ROI Calculator

Estimate the return on investment for outsourcing payroll in India 2025.

Unique Insights & Actionable Advice

- Checklist for choosing a payroll outsourcing partner: financial transparency, compliance expertise, customer support, technology stack, and flexibility.

- Timeline for smooth transition from in-house to outsourced payroll (~4-6 weeks with testing phases).

- Frequently overlooked savings: reduced employee grievances due to timely and accurate payments improving retention.

Case Study: How JZ Payroll Outsourcing Helped a Delhi-Based Startup Save 35% and Avoid Compliance Risks

A Delhi startup struggled with high payroll overheads and frequent compliance gaps risking penalties. Implementing JZ’s affordable and scalable payroll outsourcing solutions, the startup replaced manual processes with digital automation. Statutory deductions and filings became timely and error-free, producing a 35% cost reduction in payroll expenses. Additionally, audit readiness improved, reducing stress during government inspections and boosting employee confidence through transparent pay management.

Frequently Asked Questions (FAQ)

- How much can small businesses save by outsourcing payroll?

Savings between 20-40% are common due to reduced software, staff, and error-related costs. - Is payroll outsourcing suitable for startups?

Yes, especially for startups seeking agile, cost-efficient compliance solutions. - How does JZ ensure compliance with Indian labor laws?

JZ’s experts constantly monitor regulatory changes and conduct compliance audits. - Will outsourcing payroll impact employee data security?

Reputable providers use encrypted platforms and strict data privacy protocols. - How quickly can we switch to outsourced payroll?

Typically 4-6 weeks, including data migration and parallel runs for accuracy. - Can payroll outsourcing handle statutory compliances?

Yes, full statutory filings are managed as part of the service package. - What industries do you serve?

From IT startups to manufacturing and retail, JZ serves diverse sectors with tailored solutions.

Why Choose JZ Payroll Outsourcing & Contract Staffing?

JZ is India’s trusted leader for affordable payroll outsourcing solutions for SMBs India 2025, combining 20+ years of experience with advanced automation and compliance expertise. Partner with us for transparent pricing, personalized support, and scalable payroll solutions designed for your industry and growth phase.

Ready to save big and simplify your payroll? Contact JZ Payroll Outsourcing & Contract Staffing now for a free consultation or download our Payroll Savings Checklist.

📞 Phone: 9911824722

📧 Email: pyushverma@contractstaffinghub.com

🌐 Website: www.contractstaffinghub.com