Discover cost-effective payroll management outsourcing and compliance solutions for startups and SMEs in India 2025. Streamline payroll with expert guidance.

Introduction to Payroll Outsourcing: Why Modern Business Needs It

In the fast-paced landscape of 2025, businesses, especially small and medium enterprises (SMEs) and startups in India, face complex challenges managing payroll and compliance. Payroll outsourcing has emerged as a critical solution to help companies navigate these hurdles efficiently while focusing on growth. This guide unveils the benefits of payroll outsourcing for small businesses in India and provides actionable advice for seamless adoption.

Why Payroll Outsourcing? A Strategic Business Move

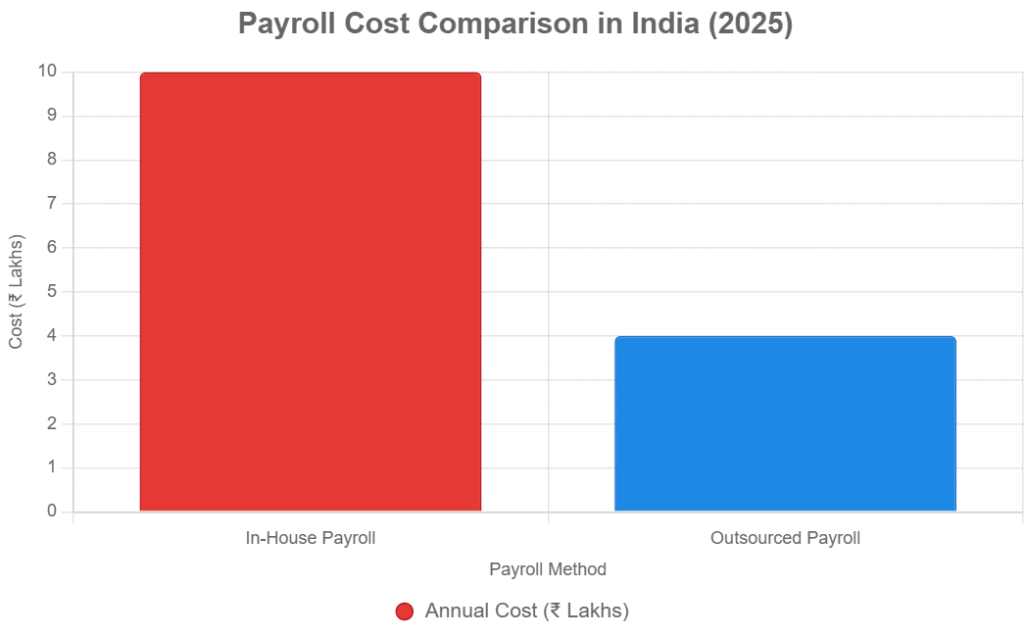

- Cost-efficiency: Outsourcing turns fixed payroll costs (software, HR staff salaries) into scalable expenses, reducing overhead.

- Compliance risk reduction: Specialized providers stay updated on evolving Indian payroll laws, preventing costly penalties.

- Access to payroll experts and technology: Enjoy advanced, automated payroll platforms without heavy investment.

- Streamlined payroll processing for SMEs: Simplify salary disbursement, statutory deductions (PF, ESI, TDS), and filings.

- Enhanced data security: Vendors invest in secure, compliant systems to safeguard sensitive employee information.

- Scalable solutions: Effortlessly adjust payroll processes during business expansion or seasonality.

- Focus on core business: Free internal teams from administrative burdens to drive strategy and innovation.

Step-by-Step Payroll Outsourcing Adoption Guide

Step 1: Assess Your Payroll Needs

- Audit current payroll processes and compliance gaps

- Define requirements for employee categories, statutory filings, and reporting

Step 2: Choose the Right Partner

- Evaluate payroll service providers based on expertise, technology, pricing, and client support

- Prefer partners familiar with Indian labor laws and sector-specific needs

Step 3: Transition Planning and Execution

- Share employee data securely and setup automated reporting

- Establish SLAs for accuracy, timeliness, and compliance

- Conduct parallel runs to ensure smooth transition

Step 4: Monitor and Optimize Payroll Operations

- Regular audits and updates reflecting new regulations

- Use analytics to identify bottlenecks and cost-saving opportunities

Payroll Outsourcing ROI Calculator

Estimate the return on investment for payroll outsourcing in India 2025.

Unique Insights & Common Pitfalls

- Plan for cultural shifts: transparency nurtures employee trust during outsourcing transitions

- Beware of hidden fees; clarify contract terms upfront

- Data privacy compliance (e.g., IT Act) is crucial in payroll outsourcing

Case Study: Delhi Startup Triples Growth with Payroll Outsourcing

A fintech startup in Delhi faced payroll processing delays and compliance risks limiting scalability. Partnering with JZ Payroll Outsourcing & Contract Staffing, the startup gained expert guidance, access to automation tools, and compliance assurance. Payroll errors dropped by 95%, and the startup reallocated 20% of HR time to strategic initiatives. This seamless solution enabled rapid hiring and market expansion while avoiding regulatory penalties—a testament to payroll outsourcing’s transformative impact.

Frequently Asked Questions (FAQ)

- Is payroll outsourcing expensive for small businesses?

Outsourcing often saves costs compared to maintaining in-house staff and software. - How does outsourcing reduce compliance risks?

Payroll experts handle statutory filings accurately, ensuring adherence to complex laws. - Can payroll outsourcing accommodate growing teams?

Yes, services scale with your workforce size and complexity. - What data security measures should I expect?

Reputable providers use encrypted platforms, secure access controls, and comply with Indian IT laws. - How long does the outsourcing transition take?

Typically 4-6 weeks, including data migration and validation. - Does outsourcing improve payroll accuracy?

Automation and expert oversight significantly reduce errors and late payments. - Can JZ Payroll Outsourcing & Contract Staffing customize payroll solutions?

Absolutely—tailored services for SMEs, startups, and multinational clients ensure fit-for-purpose solutions.

Why Partner with JZ Payroll Outsourcing & Contract Staffing?

JZ Payroll Outsourcing & Contract Staffing is India’s most trusted partner, delivering cost-effective payroll management outsourcing and compliance solutions. With over two decades of expertise, we serve businesses across sectors, leveraging global best practices and deep local insights to ensure payroll accuracy, risk mitigation, and operational scalability.

Transform your payroll operations today with JZ Payroll Outsourcing & Contract Staffing. Contact us now for a free consultation or download our Payroll Outsourcing Checklist.

📞 Phone: 9911824722

📧 Email: pyushverma@contractstaffinghub.com

🌐 Website: www.contractstaffinghub.com